Federal Solar Tax Credit to Reduce in 2020

October 22, 2019

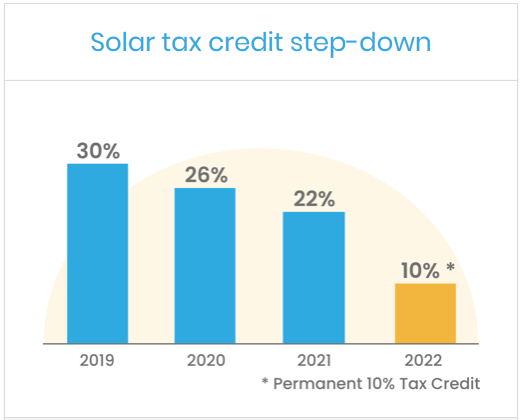

The federal solar tax credit, formally known as the solar Investment Tax Credit (ITC), is set to reduce in 2020. Given that it is mid-to-late October, this means you only have two months or so to take advantage of the credit before it reduces. Until 2020, the credit is equal to 30% of the qualified system costs of installing a photovoltaic (PV) solar system. Once 2020 hits, however, the credit will reduce by 4% each year until 2022, at which point commercial owners will only receive a 10% credit for their solar systems.

The total value of the credit is calculated by taking 30% of the PV solar system installation cost, and there is no limit to the value of the credit. The credit is a non-refundable tax credit, meaning you only get a refund up to the amount you owe in federal taxes. Moreover, the credit is only available to the owner of the system, meaning that homeowners with a PV system through a Solar Lease or PPA (Power Purchase Agreement) are not personally eligible for the credit. Below is depiction of the credit amounts for commercial owners for 2019, 2020, 2021, and 2022, courtesy of www.solar-estimate.org: